In the world of high finance and elite sports, decisions made by influential figures can have far-reaching consequences. Recently, Stephen Curry’s billionaire boss has made headlines by choosing to part with a highly coveted property, signaling a shift in priorities that could have significant implications.

The decision to let go of the dream property appears to be more than just a real estate transaction. It reflects a strategic move to boost financial earnings, demonstrating that even billionaires are not immune to the need for maximizing wealth. By freeing up capital from this high-value asset, Curry’s employer is now positioned to redirect resources towards investments that promise higher returns.

FULL VIDEO:

This move might hint at a broader trend among the ultra-wealthy, where personal luxury assets are increasingly seen as secondary to the growth of financial portfolios. As markets evolve and new opportunities arise, the focus on enhancing wealth becomes ever more critical.

For Stephen Curry, being associated with such a powerful financial mind could potentially open up new avenues in wealth management and investment strategies. The ripple effect of his boss’s decisions might influence not just the financial landscape, but also the opportunities available to those within his orbit.

As the story unfolds, it will be interesting to observe how this shift in focus impacts both the billionaire’s financial standing and the broader market. The decision to prioritize earnings over personal luxury could very well set the tone for future strategies among the elite.

News

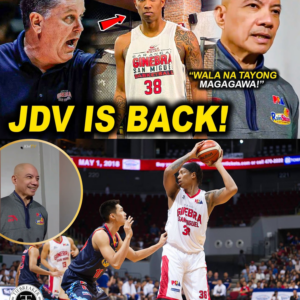

JOE DEVANCE BALIK GINEBRA! Maglalaro sa Playoffs! Coach Yeng May Parinig kay Commissioner Marcial!

Joe Devance Returns to Ginebra for PBA Playoffs; Coach Yeng Questions Playoff Format The PBA world is buzzing as Joe Devance, a veteran of Barangay Ginebra, makes his return to the court for the upcoming Governor’s Cup Playoffs. His…

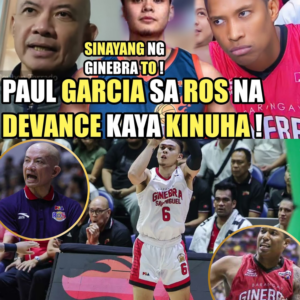

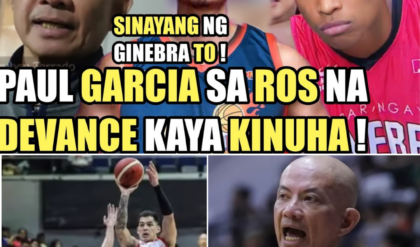

GINEBRA JOE DEVANCE KAYA PALA KINUHA | PAUL GARCIA SA RAIN OR SHINE NA | SINAYANG NG GINEBRA !

Joe Devance’s Surprising Return to Ginebra and Paul Garcia’s Potential Future with Rain or Shine The latest developments in the PBA (Philippine Basketball Association) have stirred up much excitement and speculation, especially surrounding two prominent players: Joe Devance’s return…

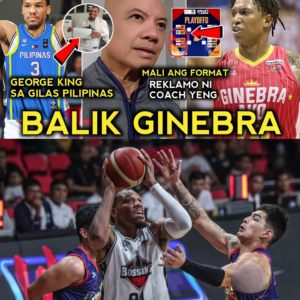

GINEBRA JOE DEVANCE BAKIT KINUHA GAANO KALAKI IMPACT SA PLAYOFFS | GEORGE KING GUSTO SA GILAS

Jo Devance’s Return Brings Stability to Ginebra, George King Eyes Naturalization for Gilas Pilipinas In recent basketball updates, two big stories have emerged in the PBA landscape. First, the return of Jo Devance to Barangay Ginebra’s lineup for the…

JOE DEVANCE BALIK GINEBRA NA, COACH YENG MAY REKLAMO SA FORMAT NG PBA SA QUARTER FINALS

Joe Devance Returns to Barangay Ginebra; Coach Yeng Guiao Criticizes PBA Quarterfinals Format In an exciting development for PBA basketball fans, especially those of Barangay Ginebra, veteran player Joe Devance is making a comeback to the court. Meanwhile, Coach Yeng…

GINEBRA JOE DEVANCE COMEBACK MAGLALARO SA PLAYOFFS | JUSTIN BROWNLEE AMINADO MATANDA NA

Joe Devance’s Comeback Set to Boost Ginebra as Justin Brownlee Prepares for Intense PBA Playoff Battle In an exciting turn of events, Joe Devance is making his return to the court as Barangay Ginebra looks to strengthen its lineup…

How Steph Curry, Draymond Green & Warriors WIN BIG in 2024

Golden State Warriors: A New Era for 2024 The Golden State Warriors are gearing up for a potentially transformative season in 2024. After a rollercoaster year in 2023, the team has made several key roster changes and improvements. These…

End of content

No more pages to load